Factors Influencing Aluminum Profile Price Fluctuations

Have you ever thought about why aluminum profile prices shift frequently? These prices really change like the weather.

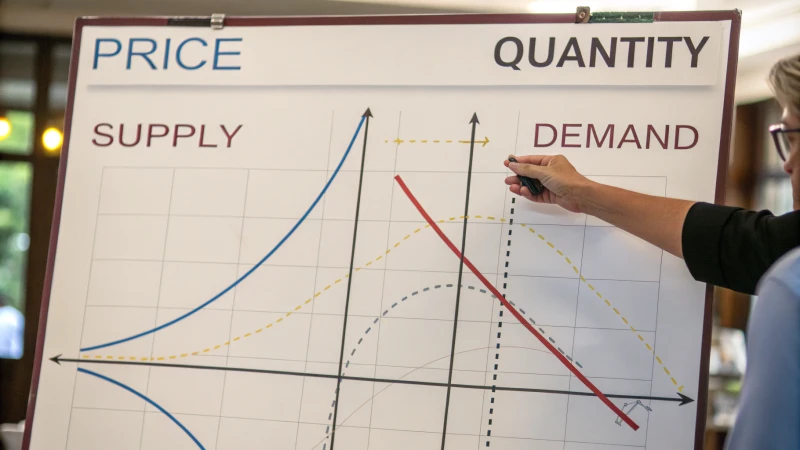

Aluminum profile prices change due to the cost of raw materials like aluminum ingots. Transport and labor expenses play a role. Supply-demand also affects prices. External events influence these costs too. Geopolitical events impact prices. Energy prices are very important.

I remember the first surprise rise in aluminum prices. It felt like a sudden storm – clear skies one moment, chaos the next. Metal prices change not just because of raw material costs or transport. Deeper factors play a role too, like global politics or energy price shifts. These changes really affect the market. Putting these factors together helps me see trends. Better choices for my business follow this understanding.

Aluminum ingot prices directly impact profile costs.True

Aluminum ingots are a primary raw material, influencing profile pricing.

Geopolitical events have no effect on aluminum prices.False

Geopolitical events can disrupt supply chains, affecting prices.

How Do Raw Material Prices Affect Aluminum Profiles?

Do you ever think about how changing raw material prices impact the aluminum profile industry? Shifting costs can really disrupt production plans and budgets. Factories might suddenly face very high expenses. They struggle to keep prices stable. Financial plans may need quick adjustments. The industry adapts to these unpredictable challenges. Prices fluctuate. This variability really affects company profits.

Raw material prices strongly affect aluminum profile costs. They impact the price of aluminum ingots. Alloying elements also matter. Transportation costs add to this. Labor costs play a role too. All these parts together form production expenses. They shape pricing strategies.

The Role of Aluminum Ingots

Aluminum ingot prices greatly influence businesses like mine. As such, changes in the price of these ingots significantly affect the cost of aluminum profiles. When ingot prices rise, manufacturers must decide whether to absorb the increased costs or pass them on to customers1. Similarly, a drop in ingot prices can lead to reduced profile costs, providing competitive advantages.

Alloying Elements and Their Impact

Magnesium and silicon add magic to our manufacturing. These elements seem minor, yet their price fluctuations change everything. Once, magnesium prices soared, turning daily operations into a risky balancing act. Every choice mattered.

While aluminum is the main component, alloying elements like magnesium and silicon also play crucial roles in profile manufacturing. Though they form a smaller cost percentage, fluctuations in their prices can impact overall production costs.

Transportation and Labor Costs

Global logistics resembles chess, where one change affects the next step. Growing transportation expenses raise product prices. Rising labor costs squeeze profits. Late-night thoughts revolved around managing these challenges while maintaining high quality.

Global logistics play a vital role in the pricing of aluminum profiles. Rising transportation costs due to global economic changes can drive up market prices. Similarly, increased labor costs affect production expenses.

| Factor | Impact on Costs |

|---|---|

| Aluminum Ingots | Directly affects base cost |

| Alloying Elements | Influences material expense |

| Transportation | Affects delivery cost |

| Labor | Impacts production cost |

Supply and Demand Dynamics

Navigating supply and demand matches surfing – perfect timing is key. High demand and low supply spike prices, while surplus supply drops them quickly.

Market supply and demand shifts significantly affect aluminum profile prices. Understanding these trends helps companies like Sinoextrud2 adapt pricing strategies effectively.

External Environmental Factors

Global events shape our operations. Energy shortages and political tensions act like unpredictable elements, disturbing supply chains and aluminum prices.

Global factors like energy crises and geopolitical tensions can influence raw material supply chains, affecting aluminum profile prices.

Rising ingot prices increase aluminum profile costs.True

Ingot prices directly impact base costs, affecting overall expenses.

Magnesium price spikes don't affect profile costs.False

Magnesium price changes can impact the cost of high-strength profiles.

How do transportation and labor costs influence business decisions?

Curious about why prices change so much? Often, hidden fees for moving goods from place to place are to blame. People involved in this process also influence the cost.

Transportation and labor costs play key roles in setting product prices and determining market strength. These expenses affect how companies produce and deliver their goods. Market prices and profit margins depend directly on these costs. Businesses need to consider these factors carefully. Products may become more expensive.

Understanding Transportation Costs

Transportation costs are a big part of pricing products. These costs include fuel, vehicle maintenance, and logistics management. My team and I once had to change our delivery routes for a large project. Small changes in logistics, like choosing intermodal transportation3, reduced costs and sped up deliveries. As e-commerce grows, balancing low costs with fast shipping becomes more important.

The Impact of Labor Costs

Labor costs, more than just paychecks, influence where production happens. They encompass wages, benefits, and taxes associated with employing workers. High salaries in one place once made us think about using automation. Sometimes we even thought of moving to areas with better labor rates4 to stay competitive in pricing. It’s not just about cutting costs; it’s about balancing growth and fair work practices.

Strategic Business Decisions

All business choices, like where to put a factory or how to price products, involve comparing transportation and labor expenses.

A table below illustrates how different industries weigh these factors:

| Industry | Transportation Focus | Labor Focus |

|---|---|---|

| Retail | High | Medium |

| Manufacturing | Medium | High |

| Technology | Low | High |

Being close to raw materials can lower transport costs but might raise labor costs depending on the area. This requires careful consideration.

Case Study: The Aluminium Industry

In the aluminium industry, where I have experience, transport costs can greatly affect prices due to the heavy nature of materials like aluminium ingots. Once, I worked with a team that placed plants near raw materials. This reduced transportation costs and helped control labor costs by improving processing efficiency5. Understanding the balance between different costs improved our strategies significantly raised our profits.

Optimizing delivery routes reduces transportation costs.True

Efficient routes minimize fuel and time, lowering expenses.

High labor costs lead companies to relocate operations.True

Firms move to regions with lower wages to cut costs.

How Do Supply and Demand Dynamics Impact Pricing?

Have you ever felt the excitement when a new product quickly disappears from stores? Prices then shoot up. That’s how supply and demand function.

Supply and demand dynamics change prices. Prices rise when demand is higher than supply. Conversely, they drop when supply is greater than demand. This connection also determines how much of a product is available. It really affects what consumers decide to buy. Without a doubt.

The Basics of Supply and Demand

I recall when I first truly grasped supply and demand. My uncle’s aluminium plant became my classroom during a summer job. There, I saw that supply and demand are not just ideas in books. They power each business trade. Simply put, supply is how much of something is on hand, while demand shows how much people want it. Market equilibrium6 is where both balance out. This balance keeps everyone happy and prices steady.

Price Fluctuations and Market Forces

Price changes feel like a wild ride sometimes. Once, a sudden rush for eco-friendly aluminium caught us off guard. Orders flooded in and prices went up because demand was high. Conversely, when we increased production, too much supply pushed prices down.

| Scenario | Impact on Pricing |

|---|---|

| Increased Demand | Prices typically rise |

| Increased Supply | Prices typically fall |

| Decreased Demand | Prices typically fall |

| Decreased Supply | Prices typically rise |

The shifts in supply and demand create a fascinating interaction. It’s like a dance.

External Influences on Supply and Demand

Outside factors often shake things up in supply and demand. I’ve noticed how an economic boom raises demand for our high-end aluminium, pushing prices higher. Technology improvements usually lower production costs, letting us adjust prices.

Case Study: Aluminium Profiles

In the aluminium industry, price changes are common. When the cost of aluminium ingots7 rises, our expenses also grow, affecting profile prices. Additional transport and labor costs add to the pricing challenge. It becomes a complicated puzzle.

Strategic Pricing Models

Facing these hurdles needs smart pricing strategies. I remember discussing with my team about using dynamic pricing—changing prices according to market moves—and penetration pricing to win more buyers quickly.

Studying pricing strategies8 is vital for businesses wanting to stay strong in the market.

Understanding these shifts allows us to set prices carefully and satisfy customers while focusing on profit margins.

Increased supply typically leads to higher prices.False

Increased supply usually leads to lower prices due to excess availability.

Economic booms can increase demand for luxury goods.True

During economic booms, consumers have more disposable income, boosting demand for luxuries.

What External Factors Can Cause Price Volatility?

Prices often change in unexpected ways. Let’s explore why this happens together. I will share both my insights and personal stories to explain the mystery behind these price swings.

Price changes often result from supply chain problems, shifts in economic rules and worldwide happenings. Identifying these issues very likely helps forecast market shifts and develop smarter plans.

Impact of Global Events

Imagine you plan a camping trip and feel excited about testing new equipment. Then, a global event like a pandemic disrupts all your plans. Think back to how COVID-19 changed everything drastically. It didn’t only disturb our daily lives; market prices also swung as production stopped and supply chains paused. This clearly shows how connected our lives and global markets really are.

| Event Type | Possible Impact |

|---|---|

| Geopolitical | Supply chain disruption |

| Natural Disaster | Production halts |

| Pandemics | Global market slowdown |

Discover more about geopolitical influences9 on market prices.

Economic Policies

Next, consider economic policies. Have interest rate hikes ever squeezed your budget? Borrowing costs rise, reducing what you spend on fun purchases. For companies, this impacts spending and investments. Trade tariffs are another concern; they add costs to imports and exports, changing global business landscapes.

- Interest Rates: Higher costs lead to less spending.

- Trade Tariffs: Costs rise for imports and exports.

Explore how economic policies10 shape market trends.

Supply Chain Variability

Think of the supply chain as the lifeline of the global economy. Any disruption, like transport issues or material shortages, can cause wild price changes. I often face this when sourcing needed materials, like aluminum profiles.

Knowing about supply chain problems11 is very important for planning strategies.

Consumer Confidence

Have you ever changed your shopping habits when feeling unsure about the future? Consumer confidence acts as the market’s heartbeat. When it drops, spending on non-essential items falls, leading to price shifts. This fact is crucial for me, considering the trust buyers have in my products.

Understand the role of consumer confidence12 in market dynamics.

Energy Prices

Energy prices play a huge role – they are like an unseen guide for production and transport costs. When oil prices rise, sectors feel the impact, affecting manufacturing and delivery costs. This is particularly relevant when planning logistics for top-quality materials.

Learn more about the impact of energy prices13 on market changes.

Exchange Rate Fluctuations

Lastly, exchange rates quietly but strongly affect price volatility. If you, like me, deal with international suppliers sometimes, currency shifts impact import costs. Watching exchange rate movements is crucial for success in global trade.

Explore how exchange rates14 influence worldwide trade and prices.

Understanding these elements helps us navigate the stormy waters of market changes with greater knowledge and readiness. It prepares us for any challenges.

Global events always stabilize market prices.False

Global events often cause price volatility due to disruptions.

Interest rate hikes can reduce consumer spending.True

Higher interest rates increase borrowing costs, reducing spending.

Conclusion

Aluminum profile prices fluctuate due to raw material costs, transportation, labor expenses, supply-demand dynamics, and external factors like geopolitical events and energy prices.

-

Explore how fluctuations in aluminum ingot prices influence the manufacturing expenses of aluminum profiles. ↩

-

Learn about Sinoextrud’s approach to managing fluctuating raw material prices effectively. ↩

-

This link offers strategies to lower transportation expenses, crucial for optimizing supply chains. ↩

-

Discover regions with favorable labor conditions for cost-effective manufacturing solutions. ↩

-

Learn about enhancing processing efficiency in aluminium plants for better cost management. ↩

-

Market equilibrium is crucial for understanding how supply and demand balance out to set prices. ↩

-

Understanding why aluminium ingot prices change helps in predicting costs for related products. ↩

-

Exploring various pricing strategies offers insights into how businesses adapt to market changes. ↩

-

Geopolitical events often disrupt supply chains, affecting global market stability. ↩

-

Economic policies shape the financial landscape, impacting consumer behavior and market conditions. ↩

-

Supply chain disruptions lead to scarcity, causing price hikes and market instability. ↩

-

Consumer confidence drives spending, influencing demand and price levels. ↩

-

Energy costs affect production expenses, influencing overall market pricing. ↩

-

Exchange rate changes alter the cost of imports and exports, affecting pricing. ↩